Latest Developments in the Indonesian Crypto Market: Indonesian Crypto Ecosystem Comes Full Circle

In July 2023, the Indonesian crypto market finally came full circle when the current Indonesian crypto regulator[1] (the Commodity Futures Trading Regulatory Agency or Badan Pengawas Perdagangan Berjangka Komoditi ("Bappebti")) approved PT Bursa Komoditi Nusantara to run the crypto asset bourse. Concurrently, PT Kliring Berjangka Indonesia and PT Tennet Depository Indonesia have been approved as the crypto assets clearing house and crypto asset custodian, respectively.

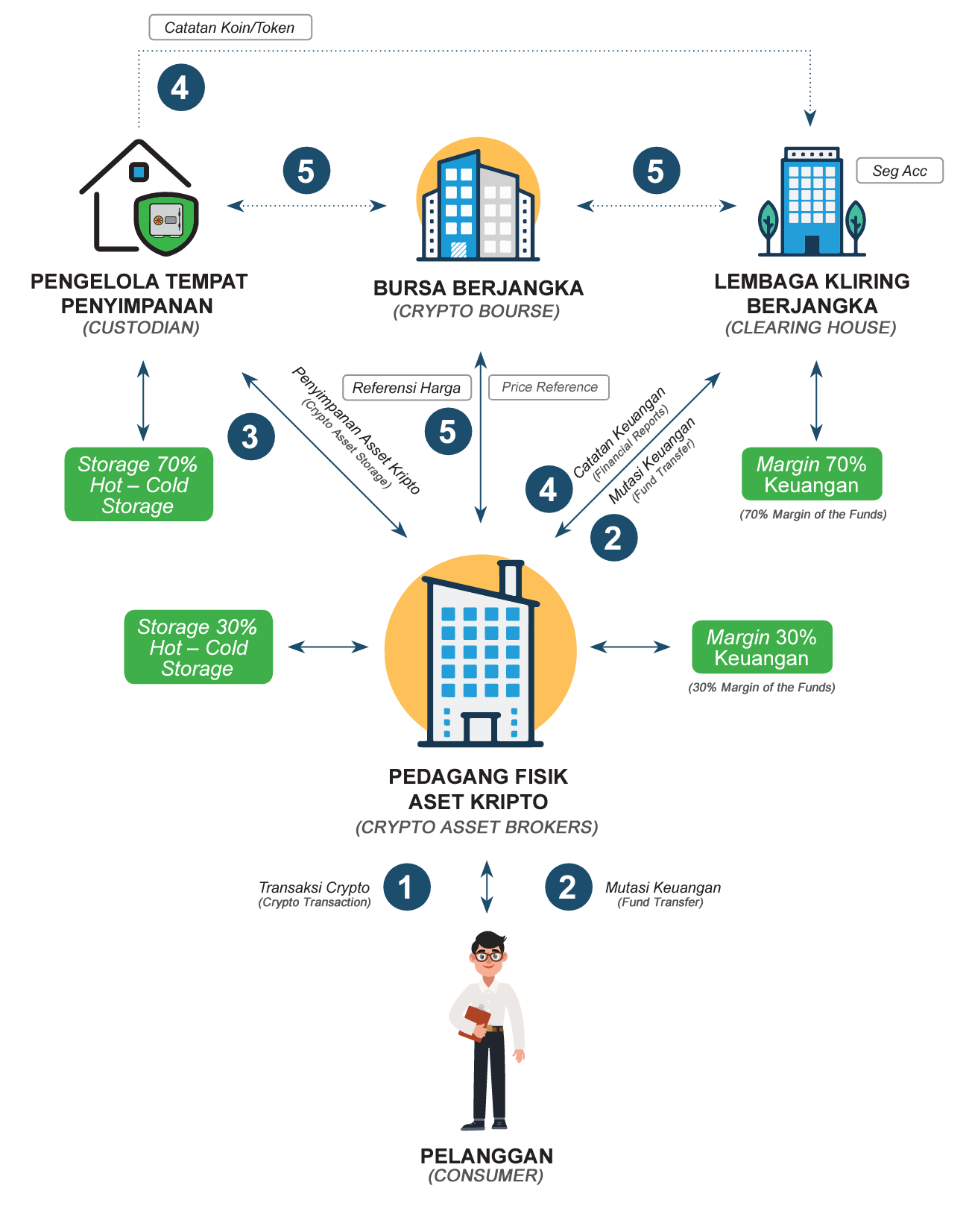

Since the crypto market in Indonesia became regulated in 2019, the crypto community has eagerly anticipated the establishment of the above three key institutions. Now that all the key institutions in the Indonesian crypto market are in place (i.e., crypto assets bourse, clearing house, custodian, and broker), we expect the market and consumers to witness enhanced transparency and safety.

As a refresher, Bappebti mandates the establishment of four key institutions to facilitate crypto transactions in Indonesia:

-

Crypto assets bourse: The institution intended to monitor crypto assets transactions.

-

Crypto assets clearing house: The institution that provides an intermediary risk management role between buyers and sellers in the payment/settlement of crypto asset transactions.

-

Crypto asset custodian: The institution that functions as a storage manager of crypto assets and provides an additional safeguard to securing crypto asset transactions.

-

Crypto asset broker: The institution that transacts crypto assets (on its or the customer’s behalf) and facilitate crypto assets transactions. At present, there are 30 broker candidates.[2]

To provide a further understanding of the above institutions, below is a visualisation of each of their roles in the Indonesian crypto ecosystem.

Recent Bappebti Circular

Around the same time as the above approvals, the Head of Bappebti issued Circular Letter No. 203/BAPPEBTI/SE/07/2023 ("Bappebti Circular") on the national crypto market key institutions. Some of the key aspects of the Bappebti Circular are as follows:

-

Exclusivity

Crypto asset bourse that has obtained Bappebti approval must focus only on crypto asset transactions and are not permitted to transact other commodities.

-

Moratorium

Bappebti no longer accepts registration for crypto asset bourses, clearing houses and custodians.

-

Approval for crypto asset brokers

Crypto asset broker candidates have one month to apply for Bappebti’s approval as a fully licensed crypto assets broker, starting from 17 July 2023. The brokers will have one year from the date of the application letter for approval as received by Bappebti to fulfil all requirements under Bappebti Regulation No. 8 of 2021 (as amended), including having a minimum capitalisation of IDR100 billion (approximately USD6.5 million) and complying with the specified standard operating procedures.

-

Status of Crypto Asset Broker Candidates

Parties who are registering to become a crypto asset broker candidate prior to the Bappebti Circular date will still have their registration process processed but will be required to comply with all the requirements under Bappebti Regulation No. 8 of 2021 (as amended) within one year of obtaining their registration certificate (tanda daftar sebagai calon pedagang fisik aset kripto).

Next Steps

Parties who intend to form part of Indonesia's maturing crypto asset ecosystem should observe the requirements and timelines set out in the Bappebti Circular.

In particular, crypto asset broker candidates intending to operate on or after 17 August 2023[3] should take active steps to apply to Bappebti and obtain the necessary approvals. Approvals and completion of all requirements must take place within Bappebti's one-year deadline.

Crypto asset bourses should also take note to keep within the scope of activities approved by Bappebti, such as limiting operations only to crypto assets.

Lastly, stakeholders in the national cryptocurrency ecosystem should also closely monitor the impending shift from Bappebti to OJK. The specifics of this transition, including associated requirements, will become evident to stakeholders once the implementing regulations of the PPSK Law are released.

[1] As required under Law No. 4 of 2023 on Financial Sector Development and Reinforcement ("PPSK Law”), Bappebti’s authority to regulate the crypto market will be transferred to the Financial Services Authority (OJK) within two years from the enactment of the PPSK Law.

[2] See https://bappebti.go.id/calon_pedagang_aset_kripto. Brokers are currently referred to as “candidates” until they have obtained Bappebti approval. By regulation, the broker candidates can only apply for such approval once the key institutions (i.e., the crypto futures exchange and crypto futures clearing house) are duly established and have secured the approval from Bappebti, which only occurred recently.

[3] Being one (1) month from the date of the Bappebti approval for PT Bursa Komoditi Nusantara as the crypto asset bourse, which approval was issued under Decree of the Head of Bappebti No. 01/BAPPEBTI/SP-BBAK/07/2023 dated 17 July 2023.

Keith Wong also contributed to this alert.