Shariah Banks Finally Enjoying the Benefits of Synergy

To further push the growth of Shariah banking, Indonesia’s financial services authority, the OJK, issued Regulation No. 28 of 2019 on Synergy of Banks under One Ownership for the Development of Shariah Banking at the end of 2019. Besides aimed to increase the efficiency of the national banking industry, the new regulation is also designed to develop Shariah banking in Indonesia by encouraging cooperation between conventional banks and Shariah banks with an ownership relationship (through common controlling shareholder or where the conventional bank is the controlling shareholder of the Shariah bank).

Under the regulation, synergy between conventional and Shariah banks is to be reflected in resources sharing, including with respect to human resources, branch network and IT. While Shariah banking in Indonesia has grown steadily, their resources are still not on par with that of the conventional banking. By allowing Shariah banks to tap into the resources of their conventional counterparts, OJK hopes that Shariah banks would finally be able to compete on a level playing field.

In human resources, the regulation permits certain members of the management to hold concurrent positions in the Shariah and conventional banks. In addition, a Shariah bank can also appoint members of the committees and the independent commissioner of the conventional bank to its corporate body.

Another sector where this synergy can be reflected is in the banking network, where a Shariah bank and conventional bank can share a branch office to serve their customers. This means that the customers of a Shariah bank are no longer required to travel to a specific Shariah branch office to conduct their banking activities. If the banks use this co-sharing model, the conventional bank needs to ensure that its office and the Shariah bank’s office are separated, and that there is no operational or reputational risk for the conventional bank.

Lastly, this synergy can be reflected in the sharing of a conventional bank’s data centre and disaster recovery centre. The Deputy Commissioner of Banking Supervisor I of OJK, Teguh Supangkat, also mentioned that the sharing of IT resources include call centre and ATM network.1

Before enjoying these privileges, banks need to be aware that the regulation specifically excludes the capitalisation and management of the conventional bank. This means that a Shariah bank cannot include the conventional bank’s capital to calculate the maximum funding limit (batas maksimum penyaluran dana), and members of the board of directors, board of commissioners (except the independent commissioner), mandatory committees and executives cannot hold a concurrent position in the Shariah bank. In addition, both banks need to enter into a cooperation agreement and submit their synergy plan to the OJK for approval. The regulation also requires the banks to set policies and procedures to manage the inherent risks of the synergy. Here, it is interesting to note only the Shariah bank will be responsible for the risks arising from the synergised activities.

There is no doubt that Shariah banks can significantly benefit from this synergy. But whether this regulation would level the playing field for Shariah banks is remain to be seen.

- https://finansial.bisnis.com/read/20191209/90/1179521/angin-segar-dari-relaksasi-aturan-bank-syariah

***

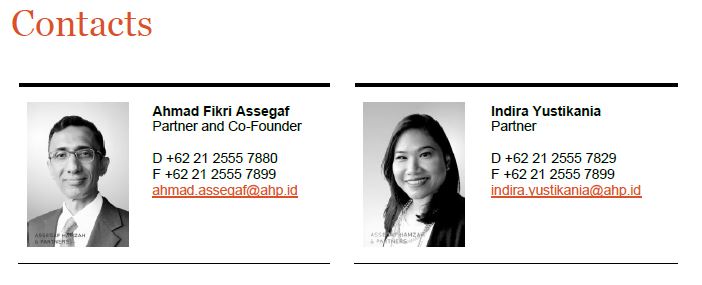

AHP Client Alert is a publication of Assegaf Hamzah & Partners. It brings an overview of selected Indonesian laws and regulations to the attention of clients but is not intended to be viewed or relied upon as legal advice. Clients should seek advice of qualified Indonesian legal practitioners with respect to the precise effect of the laws and regulations referred to in AHP Client Alert. Whilst care has been taken in the preparation of AHP Client Alert, no warranty is given as to the accuracy of the information it contains and no liability is accepted for any statement, opinion, error or omission.