New Regulation for CCS Blocks in Indonesia: is the Puzzle Complete?

Carbon capture and storage ("CCS") is recognised as a viable and effective solution that plays a key role in the effort to curb global warning. The Indonesian Ministry of Energy and Mineral Resources ("MEMR") has issued MEMR Regulation No. 16 of 2024 on the Organisation of Carbon Storage in CCS Blocks ("Regulation 16"), a significant development in the nation's efforts to advance CSS. This regulation completes the regulatory framework for CCS operations, which includes both projects within existing production sharing contract ("PSC") blocks and those in designated CCS blocks, also known as Wilayah Izin Penyimpanan Karbon ("CCS Blocks").

To gain insights into the practical implications of Regulation 16 and the future of CCS in Indonesia, we convened a discussion in January 2025 with representatives from the MEMR and the Indonesia CCS Center, the key architects of Indonesia's CCS legislation. This meeting brought together stakeholders from the upstream oil and gas industry and the carbon emitting business sectors, both of which are crucial to the development of CCS.

This client alert aims to provide a practical overview of the discussions surrounding Regulation 16 and CCS development. Specifically, it will:

-

Summarise the latest discussions on Regulation 16 and the broader development of CCS in Indonesia.

-

Highlight key provisions of Regulation 16 that address industry questions.

-

Identify any remaining questions or areas requiring further clarification.

For a comprehensive overview of the existing CCS regulatory landscape, please refer to our previous client alert, Indonesia's Carbon Capture and Storage (CCS) Regulatory Overview: Steps to become Asia-Pacific Hub? A simplified chart outlining the primary CCS regulations is provided below for your reference:

| Scope | CCS within Existing PSC Blocks | Designated CCS Blocks |

| Main Regulation | Presidential Regulation No. 14 of 2024 | |

| Implementing Regulations |

|

Regulation 16 (New!) |

| Key Business Permits |

|

|

| Key Regulators |

|

MEMR |

Highlights of Regulation 16

Awarding a CCS Block

In principle, the process for awarding a CCS Block mirrors the established tender procedures for conventional oil and gas blocks, which are familiar to upstream oil and gas companies.

When the MEMR identifies a potential area, it will conduct an open tender for the CCS Block. Alternatively, if a business entity proposes an area based on its own initiative, the MEMR will award the CCS Block through a direct selection (invitation-based or limited tender). In this case, the proposing entity will have a right to match competing offers.

The tender evaluation will focus on bidders' proposed exploration commitments, as well as their financial strength and technical performance. Higher exploration commitments proposals increase the likelihood of being awarded the CCS Block. Like conventional oil and gas blocks, the government aims to determine the feasibility of commercial CCS Block operations, and explorations are essential for this assessment.

Although Regulation 16 does not explicitly state the penalty for failure to fulfil exploration commitments, the requirement for bidders to submit a performance bond suggests that a penalty will be imposed. It is likely that the party awarded with the CCS Block will be required to pay a firm commitment penalty for non-compliance. While the exact amount of this penalty is not specified, if the government adopts the approach used for conventional oil and gas blocks, the penalty would likely be the remaining balance of the estimated expenditure for the exploration firm commitment.

Shortlisted CCS Block Bidders

The MEMR will maintain a list of shortlisted and registered potential and qualified CCS Block bidders who will be eligible to participate in CCS Block tenders. To be included in the shortlist, bidders must demonstrate their technical and financial capabilities in the oil and gas, mining, geothermal, or CCS project sectors to the MEMR.

The benefits of being included on the MEMR's shortlist are as follows:

-

While any party may participate in an open tender, only bidders on the MEMR's shortlist will be invited to participate in a direct selection.

-

Bidders on the MEMR's shortlist will be evaluated solely on their exploration commitment proposal, without the need to re-demonstrate financial and technical capabilities.

This pre-qualification process streamlines the tender process for qualified entities, ensuring efficient and effective allocation of CCS Blocks.

MEMR Approval on the Carbon Storage Agreements

A carbon storage agreement between a CCS operator and a carbon emitter requires approval from the MEMR to be effective. To obtain this approval, the CCS operator must submit technical information and the following:

-

The carbon emitter's profile and their investment in Indonesia. While the relevance of the emitter's investment amount to the approval process is unclear, this information is required.

-

The economic and financial model of the CCS operations.

-

The proposed carbon storage fee.

As seen above, financial aspects of the CCS operations are vital not only for securing MEMR's approval of carbon storage agreements, but also for determining the ongoing costs and revenue streams associated with operating a CCS Block.

Fiscal Terms of a CCS Block

Regulation 16 outlines the fiscal terms that will apply to CCS Blocks operators, which include an exploration permit compensation, royalty, and income tax. The following table provides a summary of these provisions:

| Financial Aspect | Explanation |

| Exploration Permit Compensation | When a CCS Block operator wins the tender and is awarded the exploration right to a CCS area, they will pay a one-time fee to the government. This is similar to a signing bonus in conventional oil and gas projects. The precise amount of this fee is not set by a specific rule of formula. Instead, the MEMR will decide the amount during the tender process. |

| Royalty | The CCS Block operator must pay royalties to the government based on the income they receive from storing carbon. The current rules do not specify a fixed royalty amount or how it will be calculated. The MEMR will provide an estimated royalty amount during the tender process. Later, when the CCS Block operator seeks approval for its PDO, they will propose a specific royalty amount to the MEMR. It is unclear at this time whether the government will issue another implementing regulation to set a definite royalty rate. |

| Income Tax | CCS Block operators operating CCS areas will also be subject to the applicable income tax rates on their profits. |

Bonds and Guarantees in a CCS Block

To ensure commitment and financial security in CCS projects, the MEMR requires bidders and operators to provide specific bonds and guarantees. The following table details these requirements:

| Party | Type of Guarantee | Amount | Duration of Guarantee |

| Bidders | Bid bond | 100% of the Exploration Permit compensation amount. | Six months or the duration of the tender process |

| Winner | Exploration Firm Commitment performance bond | 10% of the exploration firm commitment budget, with a minimum of USD1.5 million. | Three years from the Exploration Permit date. |

| CCS Block Operator | CCS operation performance bond | 10% of the carbon injection well budget, with a minimum of USD1.5 million. | Five years from CCS Operation Permit date (which must be extended until completion of the carbon injection well). |

| CCS Block Operator | Abandonment and site restoration bond | Amount to be determined by the MEMR during the work program and budget (WP&B) process of the CCS operations. | Annual funding in a joint account with the MEMR. |

These bonds and guarantees are essential components of the CCS project framework, designed to mitigate risks and ensure the successful execution of exploration and operational activities.

CCS Assets and Post-Operations Liabilities

During CCS operations, the assets used belong to the CCS operators. However, upon the expiry of the CCS exploration period or the termination of the CCS operations, the government may request the CCS operator to transfer the assets. This allows the government to manage the post-operational phase of the CCS Blocks. If the government exercises this right, the CCS operations would resemble a build-operation-transfer (BOT) arrangement. Furthermore, it could be argued that by acquiring the CCS assets, the government would assume responsibility for the CCS Block following the 10-year post-operation monitoring period.

Ongoing CCS Research

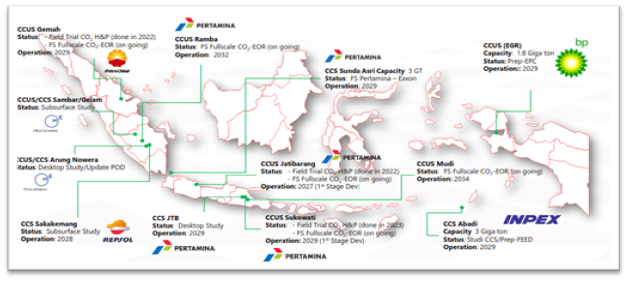

Indonesia's commitment to CCS is not only reflected in its regulatory developments but also in active research initiatives across the country. The following map illustrates the locations of current CCS studies.

Source: MEMR

Key Considerations and Future of CCS in Indonesia

Regulation 16 marks a significant step forward for CCS in Indonesia, highlighting the nation's vast potential for CO2 storage, estimated at 200 years. However, several key questions remain, indicating areas where further regulatory clarity is needed. These include:

-

The precise mechanisms for transferring long-term liabilities to the government following CCS activity closure.

-

The final determination of royalty amounts.

-

The framework for cross-border CCS arrangements.

-

The incentive packages to the CCS developers as well as the emitters.

-

The comprehensive regulatory structure for the entire CCS value chain, particularly carbon capture and aggregation from emitting industries.

The successful proliferation of the CCS industry and its value chain depends on cross-sector collaboration and, potentially, multilateral government cooperation and incentives. While the current regulatory focus has been on upstream carbon storage, a comprehensive approach is essential. To enable successful CCS industry deployments, the government must also address the entire value chain, including the carbon capture and aggregation processes of key emitters such as coal-fired power plants, steel manufacturers, petrochemical facilities, and the cement industry. This holistic approach will be crucial for the effective deployment of CCS technology in Indonesia.

Have any Question please contact

BANKING, FINANCE & PROJECT